Media was the strongest performing sector in Europe for the first time in four years in December 2025, with a rate of increase in activity rising at the fastest rate since April 2023, new data from S&P Global has found.

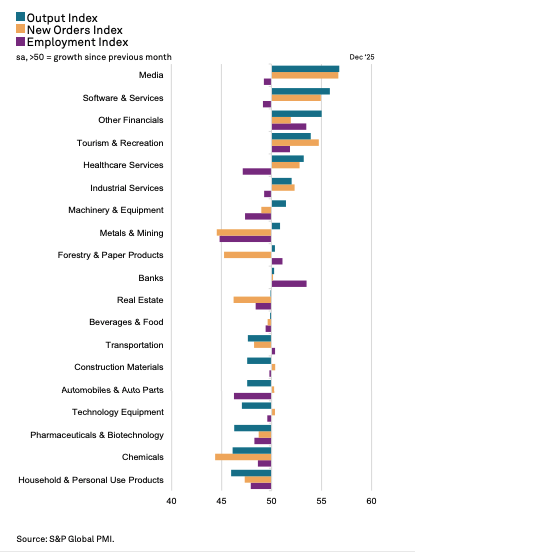

According to the S&P Global Europe Sector PMI, which manages the performance of 19 business sectors across Europe, ten sectors recorded growth in output in December, down slightly from 11 the previous month. The majority of sectors that showed growth were services-based, it noted.

Other sectors to report notable growth included Consumer Services and Tourism & Recreation, which saw its highest pace of expansion for a year, while Consumer Services overtook the Financials and Technology sector.

Weaker performance

Sectors to see a weaker performance, meanwhile, included Household and Personal Use Products, which recorded its steepest decline in production for more than a year.

‘The renewed decline in production was strong and the sharpest in over a year,’ S&P Global said of the Household and Personal Use Products sector. ‘Companies in the sector also saw a more pronounced deterioration in demand conditions.’

Of the nine sectors that reported a fall in new orders in December, eight reported contraction rates faster than in the previous month.

Workforce numbers

Just five sectors – led by Banks and Other Financials – recorded a rise in workforce numbers; other sectors to see jobs growth included Tourism and Recreation, Forestry and Paper Products, and Transportation.

Meanwhile, in terms of prices, Chemicals was the only sector to see a decrease in cost burden at the end of the year, while the sharpest increase in both input and output prices was recorded in the Tourism & Recreation sector.

‘In line with greater operating expenses, the majority of segments saw a rise in selling prices as firms sought to pass-through higher costs to customers,’ S&P Global noted.

The S&P Global Europe Sector PMI indices are derived from questionnaires sent to purchasing managers in over 8,000 private sector companies across 13 European countries. Readings above 50 indicate growth relative to the previous month, while readings below 50 indicate contraction. Read more here.