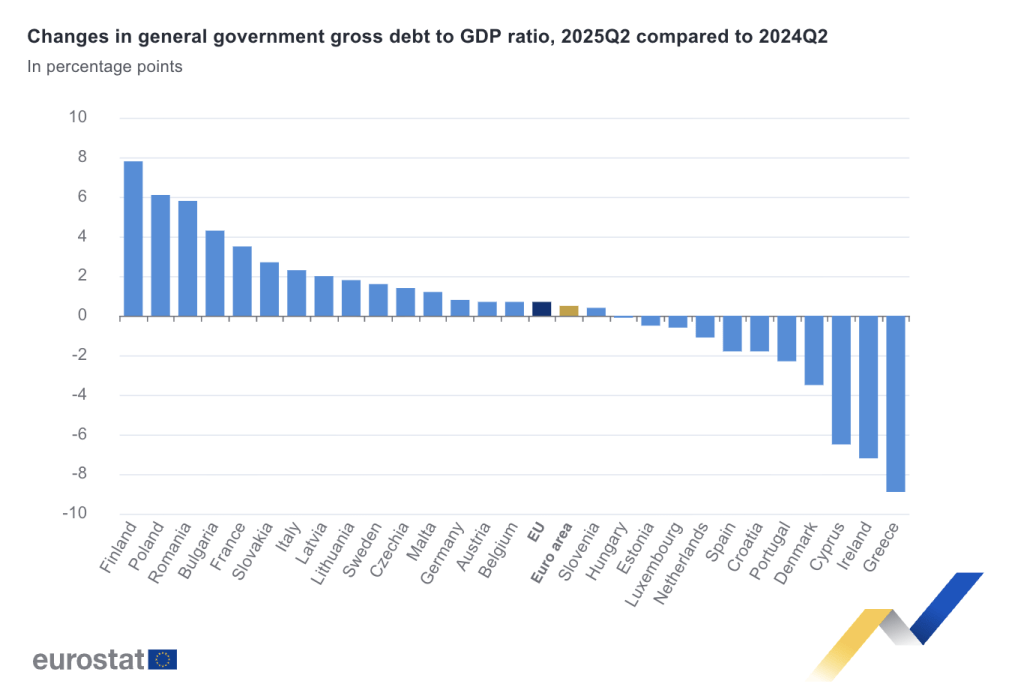

Finland reported a 7.8-percentage-point increase in debt-to-GDP ratio in the second quarter of this year, compared to the same period a year ago, the highest in the EU, new data from Eurostat has revealed.

Other countries to report a notable increase in debt-to-GDP ratio included Poland, which reported a 6.1 percentage point increase, Romania (+5.8 percentage points), Bulgaria (+4.3 percentage points), France (+3.5 percentage points), Slovakia (+2.7 percentage points), Italy (+2.3 percentage points), and Latvia (+2.0 percentage points).

A total of 16 EU member states registered an increase in debt-to-GDP ratio in the second quarter of the year, compared with the corresponding period a year earlier, with 11 registering a decrease.

The largest decreases were recorded in Greece (-8.9 percentage points), Ireland (-7.2 percentage points), Cyprus (-6.5 percentage points), Denmark (-3.5 percentage points) and Portugal (-2.3 percentage points).

EU debt-to-GDP ratio

At EU level, the government debt-to-GDP ratio stood at 81.9% in the second quarter, up from 81.2% in the corresponding period a year earlier, while in the euro area specifically, the ratio stood at 88.2%, up from 87.7% in Q2 2024.

The highest debt-to-GDP ratios in the EU in the second quarter of this year were recorded in Greece (151.2%), Italy (138.3%), France (115.8%), Belgium (106.2%) and Spain (103.4%). The lowest ratios were observed in Estonia (23.2%), Luxembourg (25.1%), Bulgaria (26.3%) and Denmark (29.7%), the data showed.

Debt securities

On a segment-by-segment basis, debt securities represent the largest share of government debt in the quarter, accounting for 84.2% in the euro area and 83.7% in the EU, Eurostat’s data showed. Loans made up 13.2% in the euro and 13.8% in the EU, while currency and deposits accounted for around 2.5% in both areas.

Intergovernmental lending represented 1.4% of GDP in the euro area and 1.2% in the EU. Read more here.